Imperial Innovations

We are a technology commercialisation company, combining the activities of technology transfer, intellectual property licensing and protection, company incubation and investment. We are focused on the commercialisation of the most promising opportunities from a broad range of technology sectors, with particular expertise in therapeutics, medtech, engineering & materials and ICT.

About us Our people Investor relations£198.3m

invested in UK innovation

During the six months ended 31 January 2015 we invested £22.4 million in our portfolio.

£346.0m

Raised by Innovations

to support investment in and development of our portfolio of technology businesses.

£1 billion

invested in UK innovation

Alongside co-investors, £1 billion has been committed to our portfolio companies since 2006

£1.4 billion

Research Funding

received each year by the universities we focus on (Imperial, Oxford, Cambridge, UCL)

£22.4m

Invested

During the six months ended 31 January 2015 we invested £22.4 million in our portfolio.

35

Accelerated Growth Companies

The focus of our time and capital

Technology Transfer

Our Technology Transfer team works with Imperial College London academics and students.

We manage the translation of an idea into practice, working with academic inventors throughout the process of commercialisation, leading ultimately to licensing to industry partners, or the creation of new ventures.

Find out more

Ventures

Our ventures team creates, nurtures and invests in new technology ventures based on IP

We work to develop new company opportunities based on leading UK academic research, working with Imperial College London (& our own Technology Transfer team), The Universities of Oxford & Cambridge and UCL.

Find out moreImperial Innovations news

Innovations obtains further £50m loan facility from EIB to strengthen UK biotech & life science investment

£50 million loan facility will strengthen investment rate and scale in medtech ...

Read article

Encouraging trial results for cystic fibrosis gene therapy treatment

Imperial Innovations is pleased to note the announcement this morning that a ...

Read articlePortfolio overview

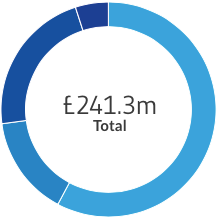

We have identified four particular areas of expertise, shown in the diagram below. As at 31 January 2015, the value of the top 20 investments in our portfolio stood at £241.3 million.

Portfolio subsectors

- Therapeutics

- Medtech

- Engineering/Materials

- ICT/Digital

Investment details

Share price: 482.50p

Key information

Sector: Financial Services

Activities: Technology commercialisation, incubation and investment

EPIC: IVO

Status: AIM

Year end: 31 July